2024 Market Predictions Are In; Consensus Is Not

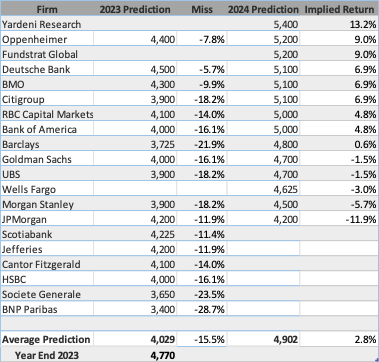

Nobody has a crystal ball; Wall Street certainly doesn’t. At the end of last year, most economists were predicting a recession in 2023. The average prediction for the S&P 500 for 2023 was 4,029; a 5% increase from year-end. Flash forward to almost year-end – we certainly aren’t in a recession and it’s hard to see one starting over the next couple of months. The S&P 500 finished 2023 at 4,770, or 15.5% higher than the consensus. If you believed the pundits and sat on the sidelines, you may have missed some nice returns. Looking toward 2024, economists have more mixed feelings, with a soft landing being the most common prediction. Some (like Ed Yardeni) are more bullish while others (like JP Morgan) are bearish. Sheaff Brock is more in the Yardeni camp but, ultimately, we don’t know.

What we are confident about is the long-term health of the US economy and the stock market continuing to increase in value. This year has again demonstrated the resiliency of the US consumer and economy. Also, there are incredibly brilliant people moving society forward, through advancements such as Artificial Intelligence (AI) and weight-loss drugs (Ozempic and Mounjaro). These were major catalysts for stock market returns in 2023. A potential way to take advantage of these forces is to invest in the stock market for a long time. There are always risks and unknowns; investing over time despite those fears could generate attractive returns.

Sheaff Brock’s use of quantitative scores and downside risk helps us select worthy stocks for our portfolios. These tools have been a tremendous help in navigating the ever-changing investing conditions and the macroeconomic environment. We look forward to serving as your advisor in 2024.

Blanks reflect unknown or no formal predictions.

Source: Market Watch and Yahoo! Finance