New Year, New High for the S&P 500

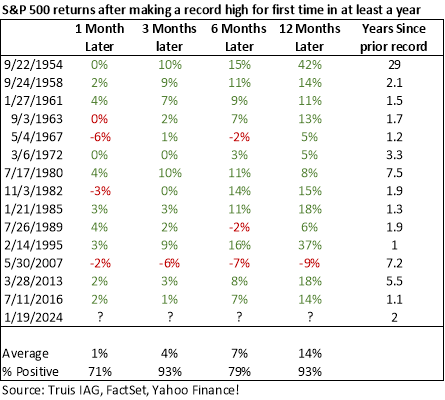

A new record! It took just over two years, but on January 19, 2024, the S&P 500 reached a new high. Truist Bank analyzed the performance of the S&P 500 after each instance in which it set a record high for the first time in at least a year. There have been 14 such instances and all except one (2007) resulted in positive returns a year later. The market can go through long periods without making new highs for a variety of reasons, but they primarily relate to recessionary or near-recessionary conditions.

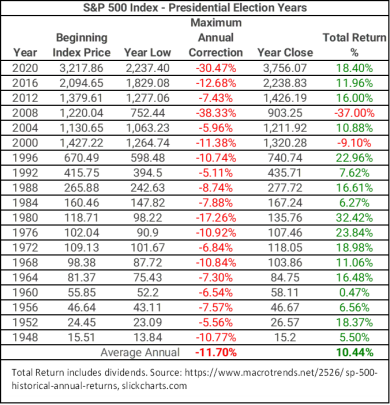

The presidential election cycle has officially begun with the first few primaries in the rearview mirror. There have been 18 presidential elections since the end of World War II. The only election years where the S&P 500 had a negative return were 2000 from the Dot-Com Bubble and the 2008 Financial Crisis (coinciding with the lone negative return in the first study).

While past performance doesn’t guarantee future results, history does have patterns and often repeats. These two separate unrelated studies provide a nice investing backdrop for the year ahead. It may be bumpy along the way, as it often does, but the future may be bright.