The Fed Cut Interest Rates—Now What?

The Federal Reserve has finally cut interest rates, a move that the market had eagerly anticipated for some time. Over the past year, investors consistently speculated that rate cuts would happen sooner and be larger than what ultimately transpired. The Fed reduced the Federal Funds Rate, or the overnight lending rate for the largest financial institutions, by 50 basis points (bps). Along with the rate cut, the Fed released data reflecting its projections for the future path of rates. Once again, the market expects larger and faster cuts than are likely to occur. So, what does this mean for investors and consumers?

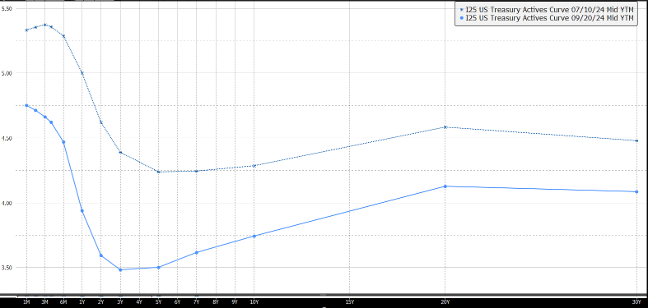

On July 11, 2024, the Bureau of Labor Statistics released its Consumer Price Index (CPI), which surprised many by revealing a more significant slowdown in inflation. Following this, market confidence grew that the Fed would soon cut rates. Investors quickly responded by buying U.S. Treasuries, causing rates to drop sharply. While the Fed controls the overnight rate, market participants drive other rates based on their expectations for Fed actions, the economy, employment, and inflation. The graph below shows the decline in interest rates between July 10 (the day before the CPI release) and September 20. Over this period, the 10-year Treasury yield fell from 4.285% to 3.742%, and the 2-year Treasury yield dropped from 4.621% to 3.593%.

These interest rate movements are where the real impact on investors and consumers can be seen. Assets are repriced at these much lower interest rates, which improves valuations—particularly in interest-rate-sensitive sectors like real estate. For consumers, borrowing costs are also decreasing. According to Bankrate.com, the 30-year U.S. home mortgage rate fell from 7.20% to 6.64% over the same period. As the Fed likely continues to lower rates, shorter-term interest rates should decline further. Longer-term rates may also decrease, but the market has probably already priced in much of this move.

The U.S. economy remains resilient, although there are some signs of weakness in the labor market. Overall, consumers are in relatively good shape, and their debt costs are falling. Equities may become more attractive as money market rates decline along with the Fed’s rate cuts. We remain bullish on both the economy and stock markets.

US Treasury Yield Curve – 7/10/2024 vs 9/20/2024

Source: Bloomberg LP