What’s Ahead for the Rest of 2024?

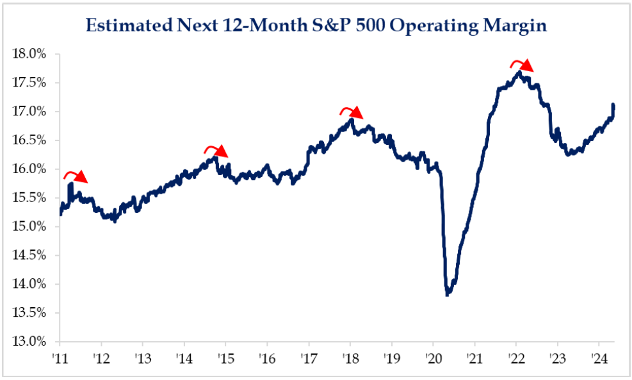

Equities continue to look pretty appealing as the Q1 earnings season is wrapping up. The cumulative effects of inflation and interest rates are having some impacts on certain areas of the economy, but the overall resiliency continues to be the major takeaway. The two charts below were published by Strategas on May 21. First, analysts are expecting the S&P 500 to see revenue growth accelerate in the next several quarters after slowing in 2023. The graph on the bottom shows an increasing operating margin for the S&P 500 based on the consensus expectations.

This outlook should bode well for the stock market. Increasing revenue growth and improving margins should combine to result in quality earnings growth. Despite macro and political headwinds, the fundamentals look appealing, which could fuel more investor bullishness.

Source: Strategas

Source: Strategas