AI and the S&P 500

Jubilant emotions related to the Artificial Intelligence (AI) revolution are likely clouding investors’ perceptions. Investors can’t seem to get enough. A handful of stocks are altering the perception of the stock market and likely the demand of non-AI companies. Through June 14 YTD, the S&P 500 Index was up 14.6% while the Equal Weight S&P 500 was up only 4.3%. YTD, Nvidia (NVDA) alone accounts for roughly one-third of the S&P 500’s total return and half of the difference between the two indices. Their recent earnings report was the can’t-wait event of the season and had Wall Street on the edge of their seats.

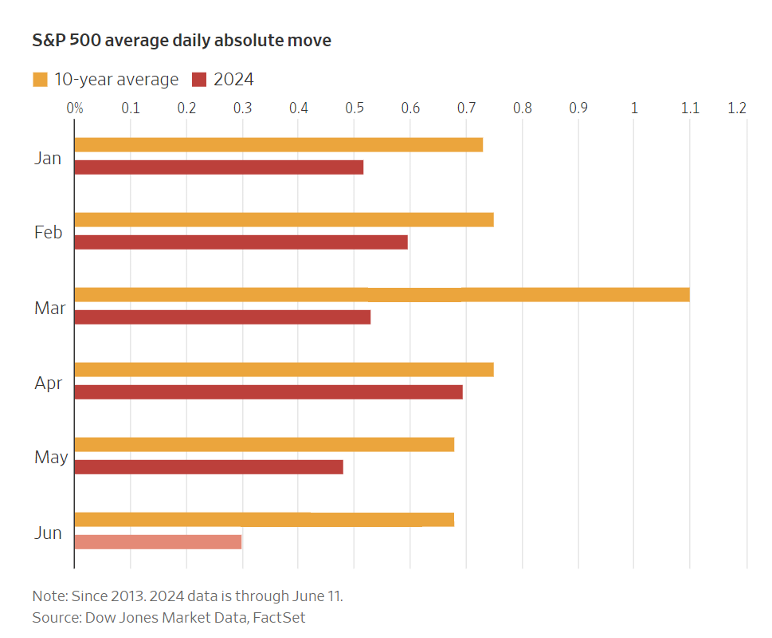

Furthermore, the strength of the ten largest stocks continues and they now comprise 34.1% of the S&P 500 Index as of month-end. Their performance has continually brought the index to record highs while dampening volatility. There has only been one day in which the market has moved up or down more than 2% in over a year, which has only happened 3 times since the start of 2023. In 2024, the CBOE Volatility Index (VIX) has averaged below 14, meaningfully lower than the historical average. These market dynamics have dampened the ability to generate much premiums for options writing.

The headline strength also masks the rest of the stock market and economy. The economy has been very resilient, but some economic indicators have been slowing. Additionally, the emotional market has shown little patience or sympathy for misses and guidance revisions. For example, Salesforce (CRM) reported on May 29 and fell almost 20% for a minor downward revision to its next quarter’s guidance. The company beat earnings per share again, the 33rd quarter in a row, according to Bloomberg. An article in the Wall Street Journal on June 9 helps paint the picture.

“Under the calm surface, however, there is furious paddling. Only once in the past 25 years have stocks swung about like this while the overall market stayed so placid. Traders in the options markets are betting on its continuing: Prices indicate the biggest swings in stocks for at least 10 years relative to the prevailing calm for the S&P 500.

One way to think about this is that, at a high level, investors think not a lot is going on. But when they look at particular stocks, the impact of the two-speed economy and excitement about artificial intelligence matter hugely. The result is far more stocks with 10% swings in a day over the past three months than at almost any other time when the market can barely get above an average move of 0.5%.” – Beneath the Calm Market, Stocks Are Going Haywire, Wall Street Journal, June 9, 2024.

The market has risen 31.9% since the October 2023 lows, a fabulous return in a short time. The largest correction over that period was only 5.5% over 16 days. Who knows how long these benign conditions will last, but it is time to be vigilant and ready. In the meantime, don’t let emotions and fear of missing out take over.