Consumers are Driving a Resilient Economy

The US economy continues to be very resilient. Pundits have been predicting a recession for a while, and many still are predicting one. A major reason for resilience has been the relative strength of the consumer. Employment levels have remained very strong with the unemployment rate at 3.8%. The September jobs report (released Oct. 6th) saw payrolls increase by a whopping 336,000. It is unlikely to have a recession with this strong jobs data.

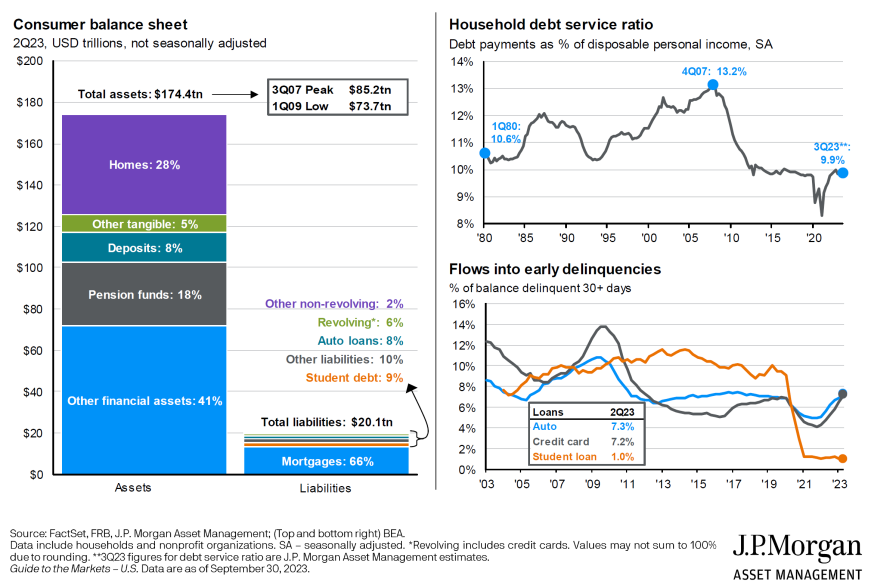

Many people point to other economic data points, such as record debt levels of the US consumer, as a signal of impending doom. Those reports only tell a part of the story—who cares if the total dollar of debt is high if people have more assets overall or are able to service that debt? JPMorgan recently published great charts (below) showing this more complete picture. Total consumer assets easily dwarf total liabilities, and debt service has increased but is relatively in line with pre-pandemic levels. These paint an almost rosy picture of the consumer, but the reality is more nuanced. Inflation is probably taking a bite out of the lower-income groups and is likely the cause of increasing delinquencies. Given the lower resources of this population, the relative impact on the overall economy is likely limited, for now.

Given the continued strength of the job market and consumer financials, a recession is unlikely to happen soon (which should bode well for the stock market). However, inflation remains sticky and interest rates are restrictive, so this picture could change.