Spotlight on the S&P 500 Index

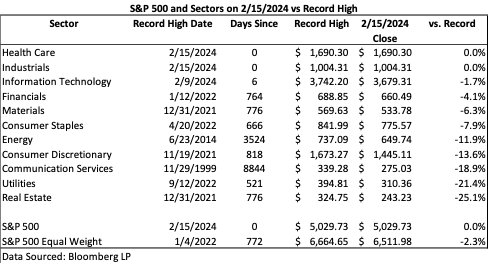

Now that is a way to start the year off! In January 2024, the S&P 500 reached a new record high for the first time in two years. As of February 15, the S&P 500 Index has set new record highs 11 times and risen 5.45% since year-end. Not the best start ever, but still solid. Much has been said about the impact the top of the market (the so-called Magnificent 7) has had on returns of the S&P 500 over the last year.

While the market rally has broadened over the last few months, the S&P 500 Equal Weight Index is still 2.3% below its record. Additionally, only three out of the eleven sectors (Health Care, Industrials, and Information Technology) have set new records this year. The other eight sectors still have work to do. On average, these eight sectors are 13.7% below their respective records.

The market constantly has an evolving set of sector leaders; Tech and Industrials have been the best-performing sectors for a while with Healthcare recently making bigger moves to join them as the market leaders. The current S&P 500 Index rally may still have more legs if the average stock (as represented by the Equal Weight S&P 500 Index) continues to approach its respective records. Given the broadening market rally and potential for a soft landing, this seems like a reasonable potential without material outlook changes.