Rising Mortgage Rates? What’s the Net Effect?

The national average mortgage rate has been climbing all year, from 6.42% at year-end to 7.19% as of 9/21/2023 (according to the St. Louis Federal Reserve). Bankrate.com has the average 30-year mortgage rate as high as 7.75%! Less than two years ago the rate was around 3.0%. What have been the ramifications of this dramatic increase in mortgage interests?

For most homeowners, the increase doesn’t mean anything! According to First Trust, 95% of mortgages are fixed-rate, so the rapid increase in rates isn’t felt. Since the vast majority have been in their homes and refinanced at low rates, the average interest rate outstanding is only 3.7%. Because so many have low rates, owners are hesitant to move and be forced into a much higher mortgage rate. The term for this is “mortgage lock-in.”

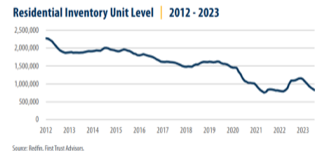

As a result of the mortgage lock-in effect, existing home inventory levels are extremely low. The National Association of Realtors estimates the inventory of existing homes for sale at only 3.3 months, well below the estimate of a ‘normal’ market at 5.0 months. First Trust estimates housing inventory to be ~48% lower than the pre-pandemic levels four years ago (July 2019). Houses in many areas are quickly being sold and the average listing is only 20 days.

When the Federal Reserve began raising rates in early 2022, many pundits predicted material declines in home prices. The biggest fearmongers were thinking the decline would be on par with the Great Recession. The reality has been far different for the average home across the country. In many areas, the declines were limited and short-lived. The lack of inventory and inflationary input costs have kept prices up. Over the last year, the Case-Shiller Home Price Index saw modest declines, but the recently released July report reached a record high. While in some areas of the country (for example Bay Area) prices have retreated a greater amount, but the decline is more related to the excessive increases leading to the peak and lower valuations of most tech companies.

S&P/Case-Shiller U.S. National Home Price Index for the last 5-Years

The net effect of the Federal Reserve has been mixed. They were successful in dramatically reducing the pace of homebuying, and maybe the pace of home inflation. However, price declines and thus affordability have been elusive given the rates and associated lock-in effects. For most homeowners, the rates aren’t impactful other than less willingness to move. It has also helped keep owners’ equity levels at very healthy levels. As a result, the market is a lot different than many had feared/predicted a year ago.

The U.S. economy has been working through tough and unique circumstances that have many people providing all sorts of different opinions. This housing market is just another example of the resiliency of the economy and the long-term health of the markets.

DISCLOSURE

Sheaff Brock Investment Advisors, LLC (“SBIA”) is an SEC-registered investment advisor founded in 2001. Clients or prospective clients are directed to SBIA’s Form ADV Part 2A prior to deciding to participate in any portfolio or making any investment decision. The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, and is not intended to predict or depict performance of any investment. Any specific recommendations or comparisons that are made as to particular securities or strategies are for illustrative purposes only and are not meant as investment advice for any viewer. The companies mentioned in the publications may be held by Sheaff Brock Investment Advisors, Innovative Portfolios, Innovative Portfolios’ ETFs or any other affiliates or related persons. Therefore, there is a conflict of interest that the advisors may have a vested interest in the Companies and the statements made about them. Past performance does not guarantee or indicate future results.